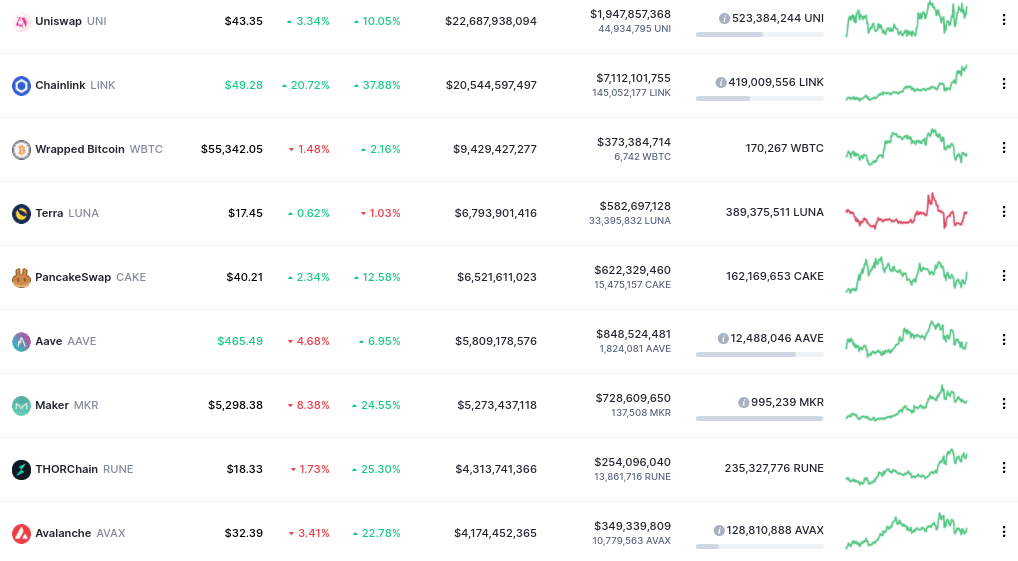

Analysts are beginning to apply methods like traditional discount cash flow valuations or multiples-based analyses on crypto assets, bringing an old school Wall Street eye to this futuristic (and often confusing) securities trade. “Protocols are continuing to show that there is real demand and a product market fit for DeFi,” Inamullah wrote, adding that they are seeing traditional financial analysis being applied to crypto protocols today. The more utilities there are, the greater the token is worth in my opinion,” she says.Ĭohasset, Massachusetts based Sarson Funds, a specialist in blockchain-related investing, said they expect DeFi will continue its “meteoric growth,” CIO Daniyal Inamullah wrote in a 19-page report published last month. Token holders of Aave get reduced fees, improved loan-to-value ratios, and staking rewards. There are some more established DeFi lending and borrowing protocols like Aave. “Token holders can deposit their funds into a liquidity pool to earn a passive income. “There is a lot of opportunity for retail investors in the DeFi space, especially for creating passive income,” says Audrey Nesbitt, Global Head of Marketing at Metaverse. Here in the U.S., DeFi payments platform Flexa has around $424 million. Badger DAO from Canada has $1.36 billion. The Australia-based Synthethix leads in derivatives DeFi with around $2.4 billion invested. In decentralized exchanges (known as DEXes), the Swiss-based and Russian created Curve Finance has $4 billion locked. It’s now $35,845 and hit an all-time-high of $49,328, on February 12.Īccording to DeFi Pulse, the current market leader in terms of investment money locked in is Danish MakerDAO (the developers of the stablecoin DAI) with over $6 billion invested. Yearn Finance (YFI) was $26,571 on December 20. The AAVE coin was priced at $85 on December 20. But as a retail investor, I am on board with the thousands of others who are all learning day-by-day and are investing in these companies and protocols side-by-side with our traditional E-Trade accounts. Right now, I don’t know what most of this means. Some of the most talked about names are those involved in decentralized exchanges (Uniswap, 0x) interest rate protocols (Aave) lending protocols (MakerDAO) are creating synthetic assets like tokenized Tesla shares (Synthetix, UMA) automated investing (Yearn Finance), and numerous investment Decentralized Autonomous Organizations (that’s what DAO stands for), just to name a few. In 2020, there was an explosion of new centralized and decentralized financial protocols created on Ethereum. I liked this blog post by them: how not to make thousands of dollars with DeFi.Ī number of cryptocurrencies have been issued by DeFi companies. ICOs and stablecoins would eventually play a key role in the growth of decentralized finance,” he says. Then a year later, the first stablecoin was created with BitShares (up 400% since December 20). “They applied a new mechanism of fundraising, very similar to the IPOs. “We can say DeFi got started around 2013, with the first Initial Coin Offering, called Mastercoin (now Omni),” says Nikita Soshnikov, director of Alfacash Store, a 9-year old cryptocurrency exchange based in Estonia.

It reportedly hit $40 billion this year, based on industry data across a host of sources and cryptocurrency exchanges. The growth of the DeFi industry accelerated in 2020, growing from $700 million by December 2019 to $13billion on December 31, 2020.

#DEFI COINS MEANING FULL#

In the sci-fi world of digital currencies, DeFi creators want to cut out traditional banks and brokers, allowing for the potential to facilitate faster, cheaper, financial transactions, all day every day, with no minimum transaction amounts, no paperwork, full transparency, and auditability.

0 kommentar(er)

0 kommentar(er)